Teaching children about money

7th May 2020

Stephen

During the past few weeks of lockdown, you might have found yourself searching for some homeschooling tips to keep your kids occupied. One invaluable lesson you could use this time to teach your children is how to use money. In this blog, we run through a few resources you can use to teach your children about money.

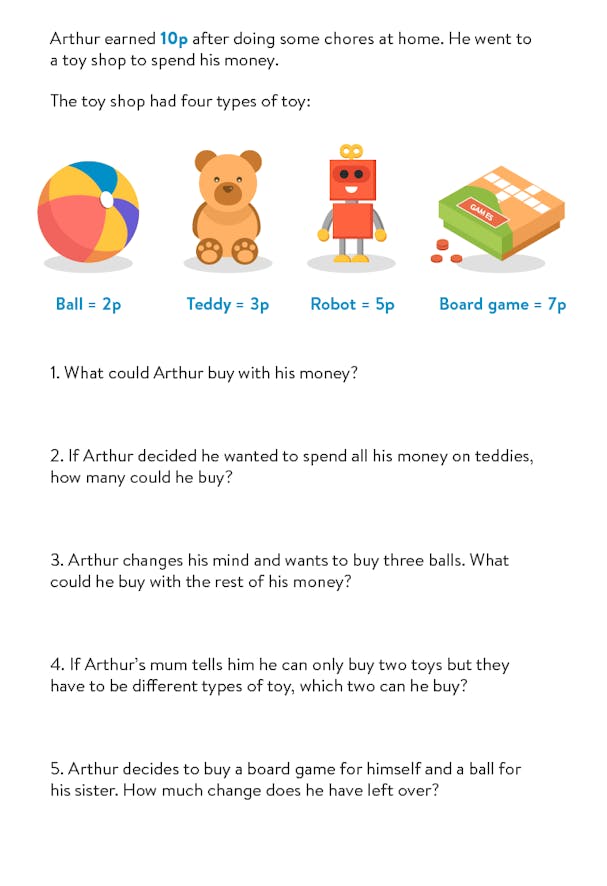

Activity sheets for learning about money from thinkmoney

As the weeks go on, we’ll be producing a few activity sheets that you can use online or print off at home. Here’s the first worksheet to get your kids started off!

What should I be teaching based on my child’s age?

While all children are different, the table below gives a fair outline of where to start depending on how old they are.

| Age | What to teach |

|---|---|

| 3-5 | Spending and saving |

| 6-19 | Goods and services, needs vs wants, and savings targets |

| 10-12 | Credit/debt and interest, budgeting, and fraud |

| 13-15 | Salaries and banking |

| 16-18 | Types of debt, credit scores, and taxes |

Useful resources

Here are a few great places to get countless hours' worth of maths lessons from covering a load of different age ranges.

- The Maths Factor - maths videos for ages 4-11

- BBC Bitesize - online maths lessons for all ages

- Topmarks - games for ages 4-13 on money and other maths topics

Practical ways to teach children about money

If you don’t want to sit your kids down to teach them about money you can still give them a few pointers on how it all works. You can follow a few of these tips and start building these tasks into your kids’ routines to get them up to speed with how money works.

Give them pocket money

Pocket money is a great way to teach your children about having and managing their own money. Not only can it help them understand how saving up money over time can allow them to buy something better than if they just spend all their money as soon as they get it, but having pocket money can be used to teach them how money can be earned for doing work if you choose to give out the money in return for doing chores around the house.

Use a piggy bank to save their money

This one’s fairly simple, but having somewhere your children can keep their money all in one place will help them establish that you can get more money by saving it up. To help this process, try using a clear jar rather than a traditional piggy bank, as this will show them how the money builds up over time.

Set saving targets

Once you’ve started giving your children pocket money, a great way to teach them about saving is to give them a target. The simplest way to do this would be to find something that they want to buy but is too expensive to get after just a week or so.

To take this a step further, you could set up a budget so that they don’t have to put all of their money towards their savings target. For example, if their pocket money is £2.50 a week, and they want to buy a toy that costs £10, you can show them how much they need to save if they want to buy it in five weeks time.

You can help them set up their savings target using this spreadsheet:

Wants vs needs

An important point to establish with your children is the difference between wants and needs. Even if they understand how money works, putting that knowledge into practice takes time. If they’ve set up a budget to save for a toy or game they’d like, you might want to take the next step and have them help plan your weekly food shop, as this is the perfect way to highlight the difference between wants and needs.

< Back to articles